What is P&L?

Whether you are working in the restaurant industry, hotel, or any other industry there will be a time you will be facing P&L. But before we go through into Restaurant P&L, let’s better understand what P&L is. Well, to put it shortly P&L stands for Profit and Loss, whether for a restaurant, company, or any other business. P&L is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time, usually, it’s monthly or a fiscal quarter or year. This statement provides information about the company’s ability to generate profit by increasing revenue, reducing costs, or both.

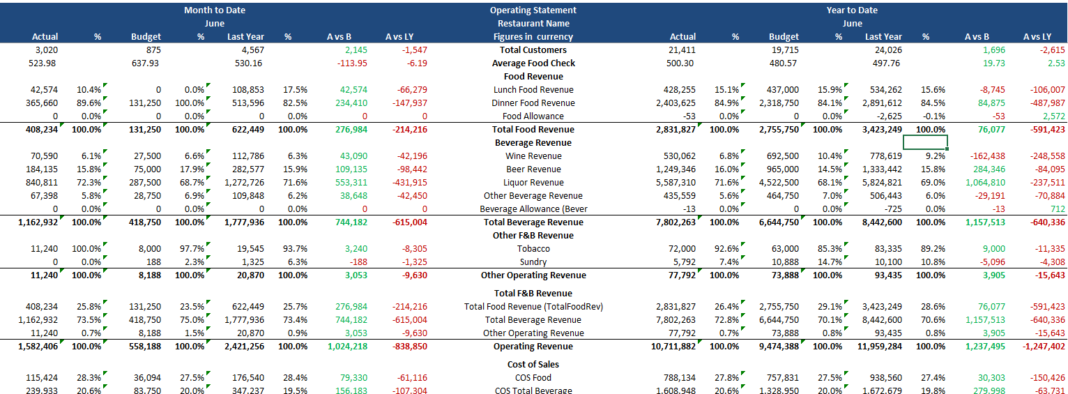

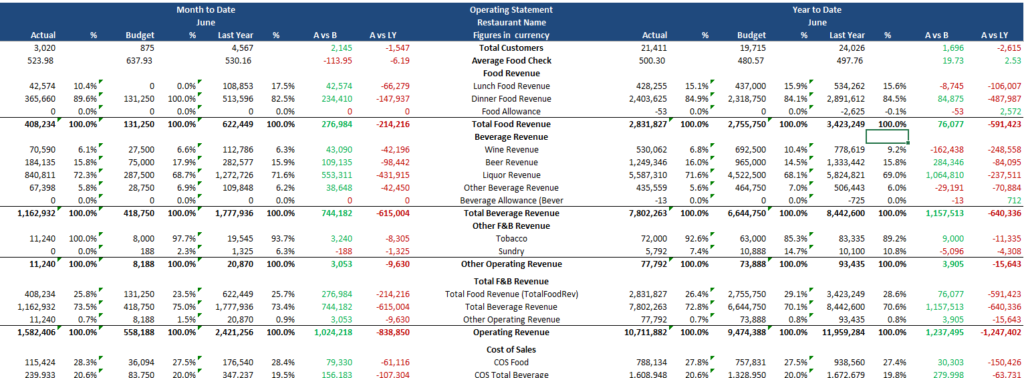

Restaurant P&L Sample

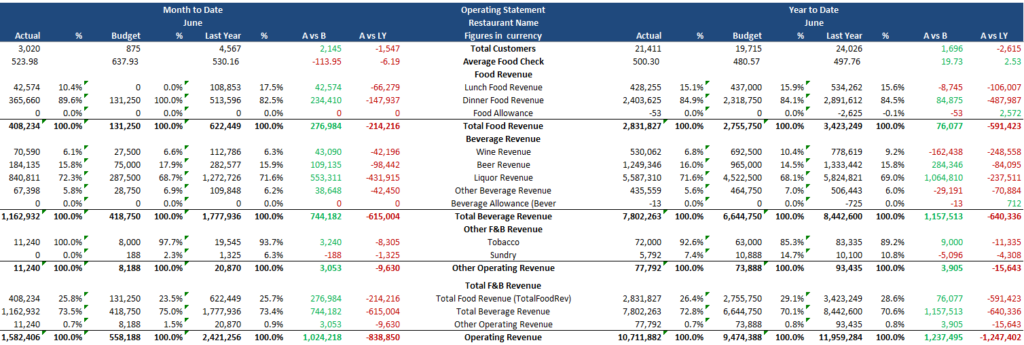

Every hotelier or restaurant manager should have a deep understanding of the place he manages the P&L. Restaurant P&L explanation helps managers see if the business is making a profit or a loss. The data shown in P&L are critical for making strategic decisions to improve profitability. Also by analyzing costs, managers can identify areas where expenses can be reduced or better controlled. Now that we have the generic idea of what P&L is, let’s go into numbers. In the example below, we have a restaurant P&L explanation which is based on June 2024 (whole month).

Before we go into numbers, let’s have a better understanding of the below column terms:

On the left side of the table we have the Month to Date section which means all the numbers on the left side are for the mentioned month (from the beginning of the month till the current date), which in our case is from 1st till end of the month. In the Actual column as u can guess are the actual numbers and in the Budget are the budgeted numbers by the manager or the owner. In the Last Year column are the numbers made in the same month a year before. A vs B are the actual numbers compared the budget, basically the difference numbers either positive or negative. A vs LY – actual numbers compared to last year’s month.

On the right side of the table we have the Year to Date section which means all the numbers on that side of the table are from the beginning of the year till the present date. Actual – actual numbers from the beginning of the year till today and so on.

Restaurant P&L Explanation

Now that we have a P&L sample and we understand the main terms let’s deep more into the revenue, profit, expenses and basically all the whole restaurant P&L explanation.

- Total Customers: The total number of customers that the restaurant during the mentioned period of time, always according to the POS.

- Average Food Check: The average food check. This have been made from the total food sales divided the customers numbers.

- Total Food Revenue: Total food revenue made from food sales only.

- Lunch Food Revenue: Total lunch food revenue.

- Dinner Food Revenue: Total dinner food revenue.

- Food Allowance: Cost of food given to the employees while on duty.

- Total Beverage Revenue: Total beverage revenue made from all the beverages.

- Wine Revenue: Total revenue made from wine sales only.

- Beer Revenue: Total revenue made from beer sales only.

- Liquor Revenue: Total revenue made from liquors only.

- Other Beverage Revenue: Any other revenue from different beverages which doesn’t belong in a certain category.

- Beverage Allowance: Cost of beverages given to the employees while on duty.

- Other Operating Revenue: Total revenue from items which doesn’t belong in the food & beverages category. In our case our restaurant have only tabaco and sundry which refers to various miscellaneous items or expenses that do not fit into specific, predefined categories.

- Total Operating Revenue: Total revenue of food & drinks and all other sales made into the restaurant.

Let’s have a break now. So far we went through the total customers and revenue made from the sales of the restaurant (food, drinks, tabaco etc…) which in our case is a total of 1,582,406 dollars for the month of June. Now you can compare the actual number with the other columns to have a better understanding where we stand. Have a look one more time on the mentioned numbers:

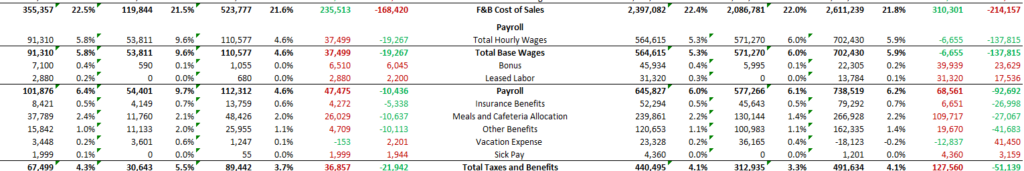

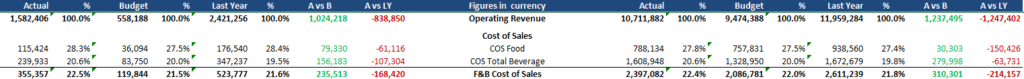

Now let’s go into other part of the restaurant P&L explanation. As u can imagine, the total revenue made is not a full profit for the restaurant. There are costs to achieve that number. In any restaurant in the world the main cost will be the cost of the food & drinks that they are selling. Let’s have a better understanding of these costs above:

- F&B Cost of Sales: Total cost of the food and drinks which is affected directly with the selling price of the item. In our case we have spent 355,357 dollars to make a revenue of 1,582,406 dollars, which gives us in percentage 22.5%.

To have a fully restaurant P&L explanation u must understand all the expenses apart from revenues. Now let’s deep into more expenses.

- Total Hourly Wages: Total salaries based on the employees hourly rate.

- Bonus: Total bonus number given to the employees (if given).

- Leased Labor: Refers to the expenses associated with hiring temporary or contracted staff through an external agency or service provider (not permanent employees).

- Payroll: Expenses of the restaurant made to its employees such as salaries, taxes, and other benefits as mentioned above.

- Insurance Benefits: The insurance that the restaurant/company pays for its employees.

- Meals And Cafeteria Allocation: The particular restaurant provides for their employees with meals on duty to a staff cafeteria so here is the total amount that the restaurant pays for this particular category.

- Other Benefits: Other benefits that employees have such as their end of service gratitude and more depending on the restaurant.

- Vacation Expense: Paid vacation of the employees.

- Sick Pay: Refers to the wages paid to employees when they are unable to work due to illness. It is a part of the broader category of employee benefits and is typically included in the labor costs within the operating expenses of a restaurant’s Profit & Loss statement.

- Payroll Taxes & Benefits: Total payroll, taxes and benefits as mentioned above, paid to the employees for the month.

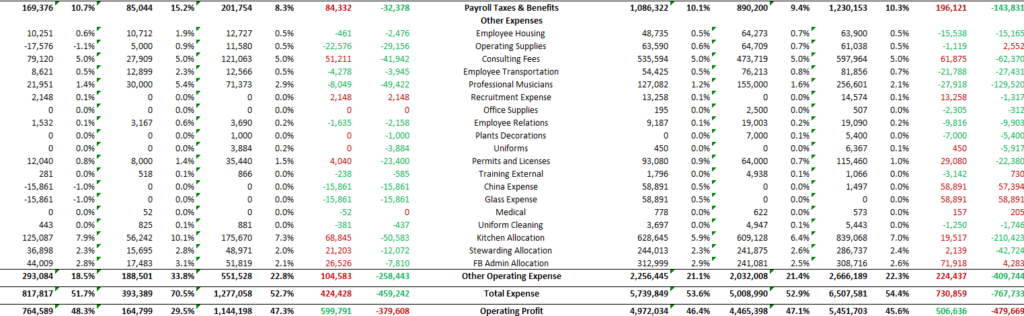

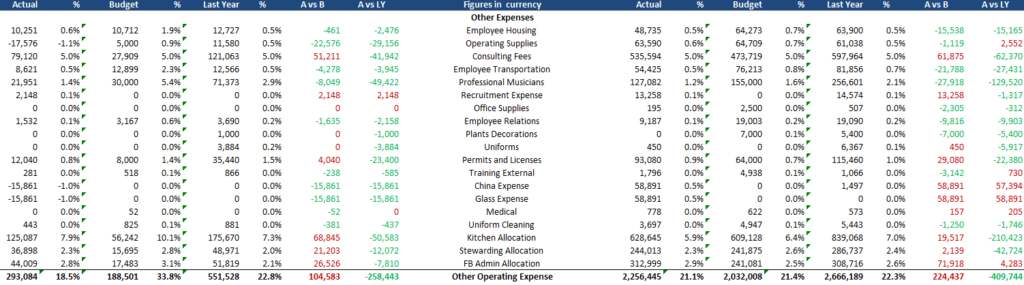

As you can see above, the restaurant paid 169,376 dollars for total Payroll Taxes & Benefits for the month of June 2024. But hold on, these aren’t the only expenses the restaurant have. Deepening of the restaurant if it’s a stand alone restaurant, chain restaurant, or a outlet which belongs a 5-star hotel and managed by the hotel management, will have different expenses. In our case, the restaurant belongs to a 5-star hotel and all the employees for it are provided with accommodation, transportation to work, laundry services and much benefits. Will continue our restaurant P&L explanation numbers as above:

- Employee Housing: The amount paid by the restaurant of the employees accommodation including taxes, gas, cable, internet and all the other amenities in the house.

- Operating Supplies: General operating supplies the restaurant have used for the month. Items such as tissue paper, printer roll and all the other general items that the restaurant needs to operate.

- Consulting Fees: Payments made to external consultants who provide specialized expertise or services that the restaurant might not have in-house. These fees can cover a wide range of services, including marketing strategy, financial planning, menu development, operational efficiency, and more.

- Employee Transportation: The transportation of the employee to come on duty and to accommodation.

- Professional Musician: Musician/Band/DJ payments that the restaurant have if they have one or more.

- Recruitment Expenses: Expenses for new hire, such as taxes, flight tickets, medical etc…

- Office Supplies: Papers, envelopes etc…

- Employee Relations: The costs associated with maintaining a positive work environment, managing staff issues, and fostering good communication between employees and management.

- Plants Decorations: The costs associated with acquiring and maintaining plants and other decorative items used to enhance the restaurant’s ambiance.

- Uniforms: The cost of purchasing new uniforms.

- Uniform Cleaning: Maintaining, cleaning and ironing the employees uniform.

- Permits And Licenses: The costs associated with obtaining and maintaining various legal permissions and regulatory approvals necessary to operate the business. These can include entertainment licenses, health permits, liquor licenses, business licenses, and other regulatory certifications required by local, state, or federal authorities.

- Training External: Expenses incurred from outsourcing training services to external providers rather than conducting training in-house. These external training services might include workshops, seminars, online courses, or consulting services that help improve employees’ skills, knowledge, and performance.

- China Expense: Costs associated with purchasing, maintaining, or replacing china (dinnerware) used in the restaurant. This includes plates, bowls, cups, saucers, and other ceramic or porcelain items used for serving food and beverages.

- Glass Expense: Costs connected with purchasing, maintaining, and replacing glassware used in the restaurant. This includes items like drinking glasses, wine glasses, beer mugs, and other types of glassware used for serving beverages.

- Medical: Costs connected with employee health and medical benefits. These expenses can include health insurance premiums, medical reimbursements, and other health-related benefits provided to employees.

- Kitchen Allocation: The distribution of costs associated with the kitchen operations including the kitchen employees total payroll and their taxes and benefits.

- Stewarding Allocation: The distribution of costs associated with the stewarding operations including the stewarding employees total payroll and their taxes and benefits.

- FB Admin Allocation: The distribution of costs associated with the food and beverages department admin such as Food And Beverages Director, assistant, coordinator and their payroll as well.

- Other Operating Expense: Total expenses of all the above mentioned costs.

As you can see the total money spent for the Other Operation Expense for the month of June is 293,084 dollars.

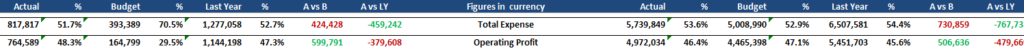

Now let’s have a look into the total expenses and the profit numbers:

Restaurant P&L Explanation | The Main Figures

Monthly Profit and Loss (P&L), June 2024 – X Restaurant

- Total Revenue: 1,582,406 USD

- Total Expenses: 817,817 USD

- Profit: 764,589 USD or 48.3%

Was a very positive month for this particular restaurant. Now that you know all the details of a Restaurant P&L explanation, you can compare the numbers versus the budget, year-to date and more.

Frequently Asked Questions:

What is P&L?

P&L stands for Profit and Loss, whether for a restaurant, company, or any other business. P&L is a financial statement that summarizes the revenues, costs, and expenses incurred during a specific period of time, usually, it’s monthly or a fiscal quarter or year.

Why is Important to Understand P&L?

Restaurant P&L statement helps managers or owners see if the business is making a profit or a loss. The data shown in P&L are critical for making strategic decisions to improve profitability.

Is the Total Revenue the Same as Profit?

No it’s not the same. Total revenue is the total sales of a period of time and profit is the total sales minus all the expenses.